Solid-State Batteries: Promise Meets Pressure

By Naveen Kindra

Solid-state batteries have carried the hopes of the EV industry for over a decade. They promise safer chemistry, faster charging, and higher energy density. For the first time, these promises are edging toward commercial timelines. But every step closer to production exposes the same question: can the economics keep up with the science?

How It Works: The Solid-State Shift

In today's lithium-ion batteries, ions travel through a liquid electrolyte. Solid-state designs replace that liquid with a solid material such as ceramic, polymer, or sulfide.

This change allows for lithium-metal anodes, which store more energy per unit of weight. The result is higher energy density, longer range, and lower fire risk.

According to The Japan Times, Keiji Otsu, president of Honda R&D, stated that solid-state batteries "will produce twice the driving range by the end of this decade and over 2.5 times more by the 2040s."

Breakthrough Momentum

Recent developments show more traction:

In an official press release, Toyota Motor Corporation announced that it has "entered into a joint development agreement" with Sumitomo Metal Mining "for the mass production of cathode materials for all-solid-state batteries," with Toyota "aiming for a market launch of BEVs with all-solid-state batteries in 2027-28."

Idemitsu plans a lithium sulfide plant to support solid-state supply. The company says lowering solid electrolyte costs is critical.

QuantumScape partnered with Corning to scale ceramic separator production.

Stellantis and Factorial Energy demonstrated prototypes reaching 375 Wh/kg and charging from 15% to 90% in under 20 minutes.

Rimac unveiled a pack with 850 kW discharge and a charge time from 10% to 80% in under 10 minutes.

The technical side is moving forward. The bigger question is manufacturing at scale.

The Real Constraint: Scale

Solid-state electrolytes must be nearly flawless. Even tiny defects allow dendrite formation. Dendrites can puncture separators and cause short circuits.

Battery experts acknowledge the inherent challenges in battery development. When discussing trade-offs in battery technology, industry researchers note that optimizing multiple performance metrics simultaneously remains one of the field's central challenges.

Current gigafactories are optimized for liquid systems. Retooling them for solid layers demands new equipment, strict humidity control, and fresh supply chains. BloombergNEF forecasts that by 2035, solid-state will represent only about 10% of battery supply because of cost and yield challenges.

Strategic Shifts in Design

Because of scaling limits, many developers are shifting toward hybrid or semi-solid designs to ease the transition to mass production.

Even industry insiders express caution. Reports indicate that major battery manufacturers remain measured about solid-state timelines, with some executives noting that conventional lithium-ion technology continues to improve rapidly.

Early Markets and Learning Curves

Solid-state batteries will likely first appear in premium segments, performance EVs, or aerospace applications. These use cases bear higher cost margins and demand higher performance early on.

The timing is strategic. Global EV sales continue to grow, creating expanding market segments where advanced battery technology can establish its foothold before scaling to mass-market vehicles.

Major automakers are developing limited solid-state programs for later this decade. These pilots generate vital data before scaling to mass-market models.

Capital and Policy Alignment

Governments and mission capital are stepping in. In Japan, METI is investing heavily in next-gen battery infrastructure. Advanced battery development programs in the United States and other regions are backing domestic pilot plants for next-generation technologies.

Public and private money must jointly take on the challenge of building reliable, efficient production—not just chemistry.

Startups Charging Ahead

While major automakers and established battery producers dominate headlines, a cohort of specialized startups is advancing solid-state and next-generation battery technologies through innovative approaches:

Sakuu Corporation is pioneering 3D-printed solid-state batteries using multi-material additive manufacturing, aiming to produce customizable battery shapes with higher energy density at lower costs through its Kavian platform.

Patent Highlight: Hybrid solid-state cell with a sealed anode structure (US 2021/0175549 A1) covers a monolithic ceramic electrochemical cell housing for solid-state batteries. Google Patents →

LeydenJar Technologies has developed 100% pure silicon anodes that increase battery capacity by 50% while reducing CO2 emissions by 85%, with its PlantOne facility in Eindhoven set to begin production in 2027.

Patent Highlight: Silicon composition material for use as battery anode (EP 4014266 B1) describes a high-capacity pure-silicon anode material for lithium-ion batteries that improves energy density and efficiency. Google Patents →

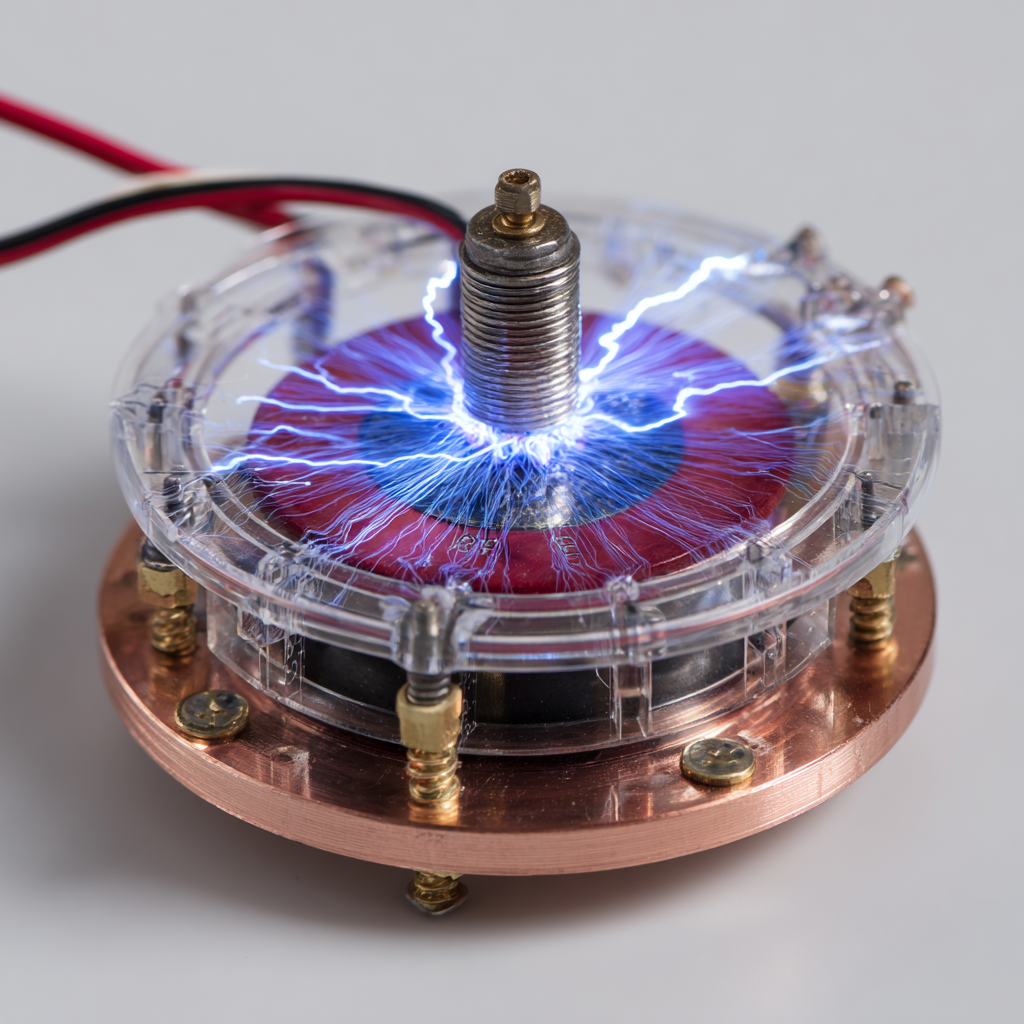

Prieto Battery is commercializing a 3D architecture using copper foam substrates with polymer electrolytes, creating interpenetrating electrodes that enable both high power and high energy density with enhanced safety.

Patent Highlight: Lithium-ion battery having interpenetrating electrodes (EP 2740172 B1) details a three-dimensional interpenetrating electrode structure using copper-foam scaffolds with solid polymer electrolytes. Google Patents →

Natrion has developed LISIC (Lithium Solid Ionic Composite), a polymer-ceramic hybrid solid electrolyte designed as a drop-in replacement for liquid electrolytes in existing manufacturing lines, improving safety and performance for EVs and defense applications.

Patent Highlight: Composite solid-state electrolyte and batteries employing the same (WO 2024/092017 A3) describes a polymer-ceramic hybrid electrolyte that can serve as a drop-in replacement for conventional liquid electrolytes in existing production lines. Google Patents →

Ilika Technologies specializes in miniature Stereax solid-state batteries for medical implants and IoT devices, as well as large-format Goliath cells for automotive applications, using thin-film deposition techniques refined through partnerships with Toyota and other blue-chip companies.

Patent Highlight: Component for use in an energy storage device (US 2024/0178387 A1) covers a thin-film solid-state battery component design used in the company’s Stereax cells and related fabrication methods. Google Patents →

Adden Energy, a Harvard spin-out, is developing fast-charging solid-state batteries featuring self-healing separators and 3D scaffolding technology that enables 10-minute charging with over 10,000 cycle lifetimes.

Patent Highlight: Electrochemical energy storage cell element (WO 2025/096945 A1) describes a solid-state electrochemical cell element that integrates self-healing separators and a three-dimensional scaffold for fast charging and long cycle life. Google Patents →

These companies represent diverse approaches to solving solid-state challenges—from advanced manufacturing processes to novel materials and architectures. Their success will depend not only on technical performance but on their ability to scale production and integrate with existing supply chains.

Outlook

Solid-state batteries are crossing the boundary from research to engineering. The core science now works. The big barrier is manufacturing thousands of perfect cells at acceptable cost.

The first production deployments are expected later this decade. Success will go to firms that master industrial consistency, not just novel materials.